Sec 206AB-Higher TDS on tax defaulters.

Sec 206AB of the IT Act 1961 will levy a higher TDS on tax defaulters from July 1, 2021. Finance Act, 2021 inserted this new section 206AB is to penalize the persons who did not file income tax returns even though he is liable to do for the previous two years and TDS deducted exceeds Rs 50,000 each year.

Also Read: Section 194N- TDS on cash withdrawal

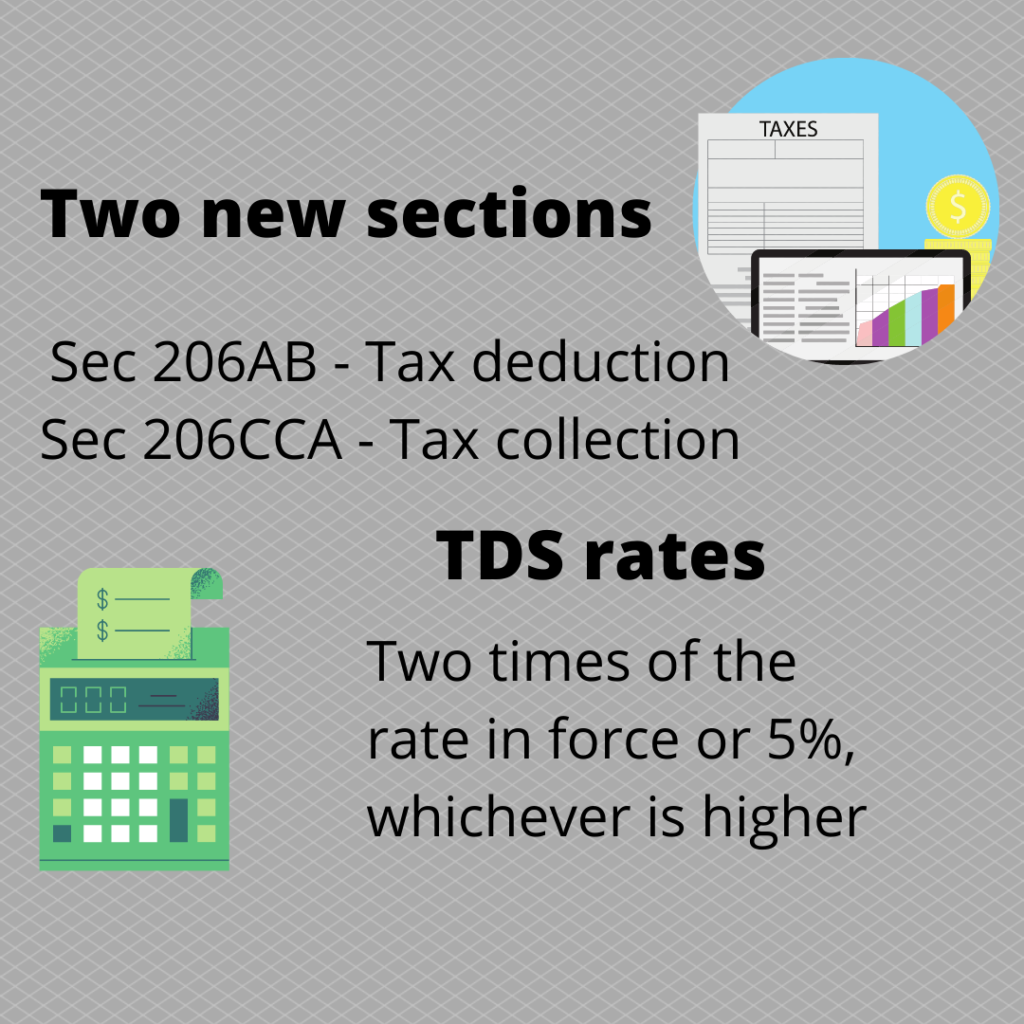

Introduction of Sec 206AB & 206CCA.

Finance Act, 2021 inserted new two sections 206AB & 206CCA. To deduct higher TDS if ITR non-filers for the previous two years and TDS exceeds Rs 50,000 each year. Section 206AB says that except salaries, TDS on any payment(other than 192, 192A, 194B, 194BB, 194LBC & 194N) to be deducted at two times the rate in force or 5%, whichever is higher. The main target is to deduct TDS from certain specified persons(non-filers). A Specified person is a person who has not filed ITR for the past two years, but tax deducted/collected is more than Rs 50,000 for each year. And also, the time limit for filing has expired under subsection(1) of section 139.

206AB – For Tax deduction

206CCA- For Tax collection

Suppose you are deducting/collecting TDS for any person, and he is non-filing even though he is liable. Then, you deduct TDS for him, either twice the rate in force or 5%, which is higher. Consider TDS is 2% for a person, and he has not filed ITR for the past two years. In that case, two times of 2 is 4%, but you know twice the rate or 5%, whichever is higher. So, you must deduct TDS at 5%. Suppose TDS is deducted at 10%, then twice the rate is 10*2= 20%. You know twice the rate or 5%, whichever is higher. So, you must deduct TDS at 20%.

Compliance Check for Section 206AB& 206CCA.

To make this extra compliance burden as easy, CBDT is issuing a new functionality, “Compliance Check for Section 206AB& 206CCA”. By visiting the portal (https:llreport.insight.gov.in), the tax deductors or tax collectors can check. A non-resident who does not have any establishment in India will not be a specified person. For any more assistance, Tax Deductors & Collectors can visit Quick Reference Guide on Compliance Check for Section 206AB & 206CCA and Frequently Asked Questions (FAQ) available under the “Resources’ section of Reporting Portal.